We explored the top-rated apps for Apple and Android to help you find the best tools for tracking your money—whether it’s for personal use, business needs, or travel expenses.

Expense tracking apps keep your finances organized by sorting your spending into simple categories. They show where your money goes, help spot ways to save, and can even guide you toward better budgeting habits. Some apps are great for everyday use, while others are built for business or global travel.

| Disclosure: This post may contain affiliate links and advertisements. We may earn a small commission or advertising fee at no extra cost to you. Learn more in our full disclaimer. |

Most apps start free, but full features like smart budgeting, receipt scanning, and report generation may come with a small monthly or yearly cost. Starting to track your expenses is the first big step—and from there, it gets easier to find what works for you.

Here’s a closer look at some of the most popular options:

Top iOS & Android Expense Tracker Apps

YNAB (You Need a Budget)

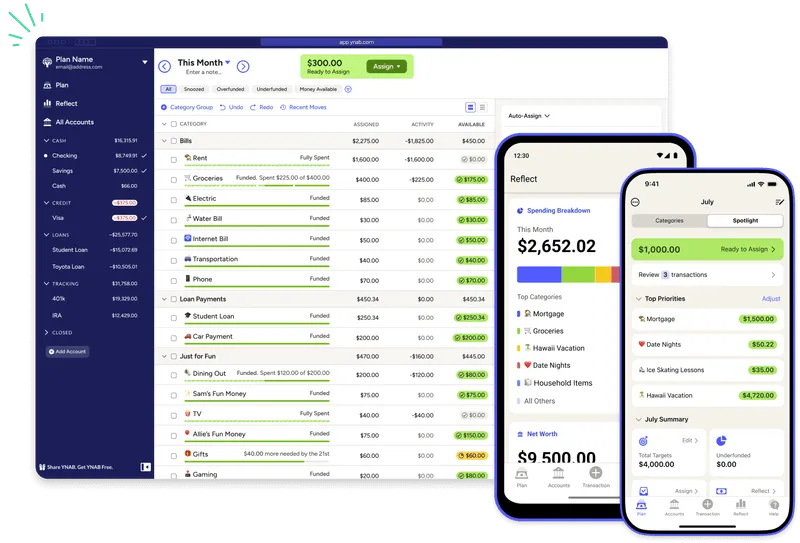

YNAB (You Need a Budget) is a budgeting app that helps you give every dollar a job. It uses a zero-based budgeting method, meaning you plan exactly where each dollar goes. This way, you’re always thinking ahead—saving on purpose and spending with a plan. It’s great for people who like to stay involved in their budget. But if you’re looking for something automatic that runs on its own, this might not be the best fit.

YNAB helps you build a budget that matches your goals. It’s known for changing how people manage money by helping them plan every dollar. You can share one plan with family or friends, track goals, and use tools to manage debt.

Cost: Free for 34 days, then $14.99/month or $109/year.

Zoho Expense

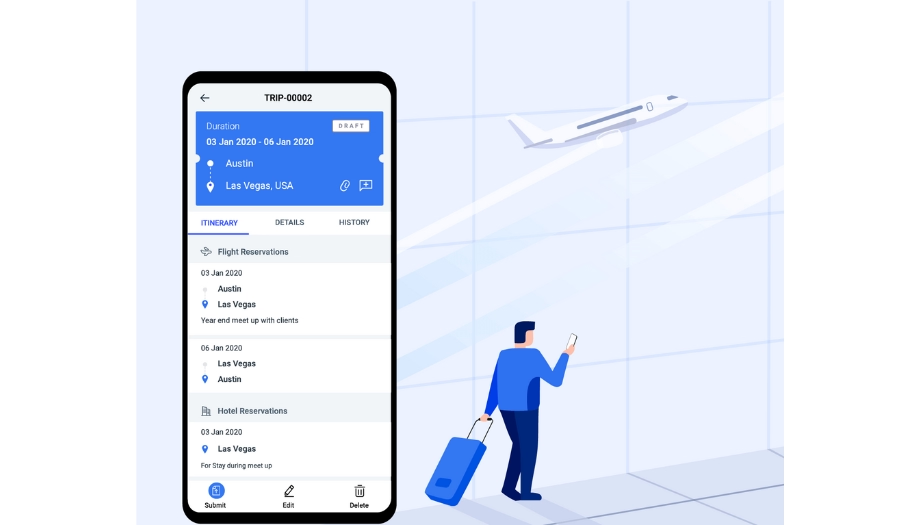

Zoho Expense is an online tool that helps businesses manage their spending easily. It comes with smart features like scanning receipts, tracking expenses automatically, and creating reports. From the moment a receipt is received to getting money back, everything is handled smoothly. The mobile app makes it simple to track expenses, snap pictures of receipts, and send in reports—anytime, anywhere.

Cost: Free basic version, with paid plans for advanced business features.

Download Zoho Expense on Android

Expensify

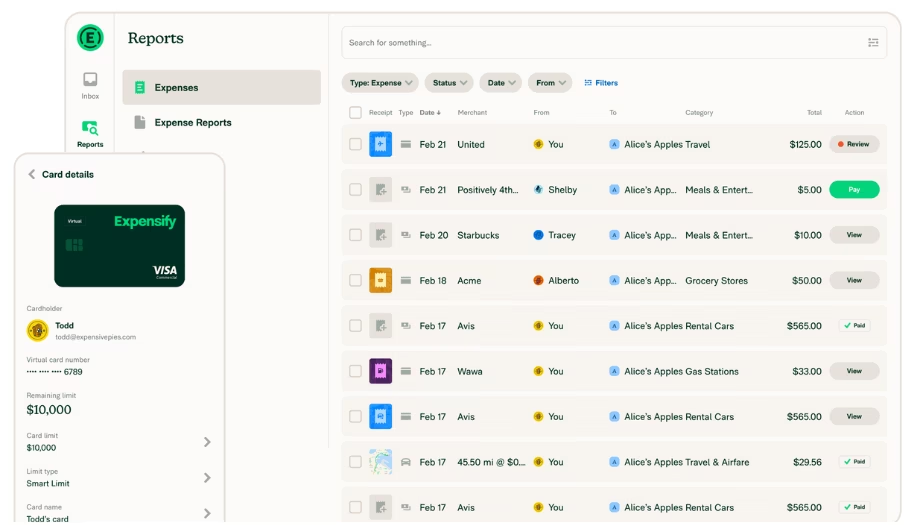

The Expensify app is the all-in-one tool for managing business and personal finances with ease. It helps track spending, scan receipts in real time, log mileage, approve expenses, send invoices, pay bills, and even book travel—all from your phone. With smart features like instant receipt scanning, global reimbursements, and advanced mileage tracking, it takes the stress out of expense management. No more delays, messy paperwork, or confusion—just simple, fast tools that give every employee what they need, right when they need it.

Cost: Free to custom pricing, based on your plan.

Rydoo

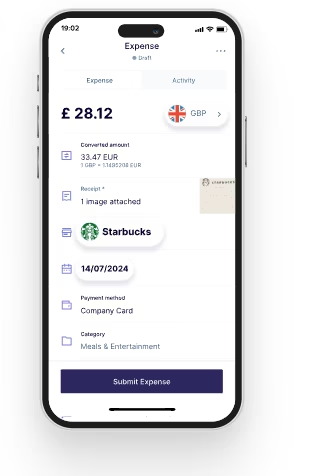

Rydoo is a smart expense management solution that helps businesses take control of their spending by automating the entire expense process. It makes it easy to manage reimbursements, track spending in real time, and stay organized without the usual stress. With the Rydoo mobile app, users can snap photos of receipts, submit expenses on the go, and keep everything digital and hassle-free. Finance teams get the tools they need to manage expenses smoothly, with better visibility and faster approval cycles. Rydoo also makes it simple to sign in, set up accounts, and start managing costs right away—all at a price that makes sense for your business.

Cost: Custom pricing for business needs.

PocketGuard

PocketGuard is a complete money management app that helps you stay on top of your personal finances with ease. It connects all your accounts in one place, so you can track spending, set budgets, and save more without the hassle. With faster app performance and better data syncing, it’s built to make money management simple and quick. PocketGuard’s smart algorithm looks at your bills and spending habits to help you plan better and avoid overspending. Whether you’re just starting or want more control over your money, PocketGuard makes budgeting easy for everyone.

Cost: Free basic version, with paid upgrades available.

Download PocketGuard on Android

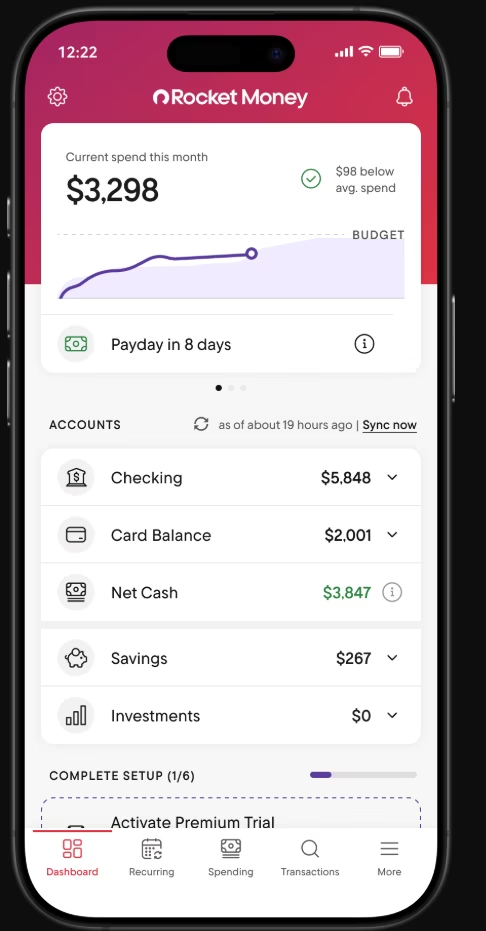

Rocket Money

Rocket Money makes managing your finances simple by helping you find all your subscriptions, track your bills, and cancel unwanted charges with just one click. It gives you clear spending insights and lets you build a budget that fits your life. Whether you’re keeping an eye on daily expenses or trying to save more, Rocket Money gives you the tools to stay in control. It’s easy to use, helps cut down on wasteful spending, and brings all your money details together in one smart app.

Cost: Free, with premium plans ranging from $6–$12/month.

Download Rocket Money on Android

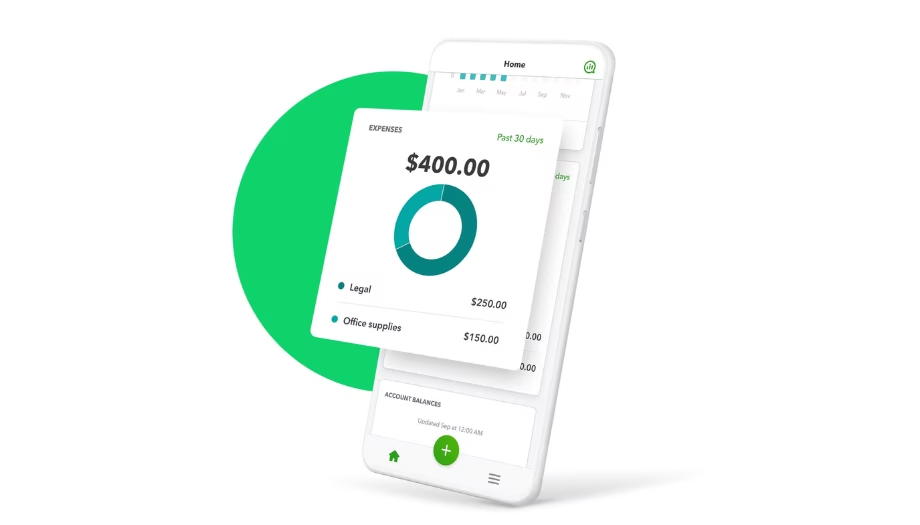

QuickBooks

The QuickBooks mobile app helps you manage expenses easily while you’re on the move. You can snap pictures of receipts, and the app pulls out details like the date, vendor, amount, and payment method. It matches these receipts to your existing expenses or creates new ones automatically. The app turns your phone into a handy receipt scanner, making it simple to keep track of spending. It also sorts expenses for you, so organizing and reporting costs becomes a breeze. Your data syncs smoothly with QuickBooks Online, keeping everything up-to-date. You can create expense reports right in the app to submit for reimbursements or tax purposes. It even tracks mileage, which is great for businesses that use cars for work. Plus, QuickBooks connects with many other apps and accounting tools, making it easier to manage everything in one place. Some plans also include time tracking, so you can monitor employee hours when needed.

Cost: Monthly plans starting at a basic level, depending on business size.

Download QuickBooks on Android

Goodbudget

Goodbudget is a budgeting and expense tracking app that uses a digital envelope system to help manage your money. Instead of just tracking past spending, it lets you plan by dividing your money into virtual envelopes for different categories like groceries, bills, or entertainment. You can use Goodbudget on iOS, Android, or through a web browser. The app lets you enter your income, track expenses by assigning them to envelopes, and keep an eye on balances across accounts like checking, savings, or credit cards. You can also set savings goals and get reports to understand your spending better. Goodbudget allows sharing budgets, so couples or families can work together. You can add transactions manually or link bank accounts to import and categorize them automatically (paid version only). The free version limits envelopes and accounts, while the paid version unlocks unlimited options, more detailed reports, and bank syncing. It’s easy to use and flexible, helping you stay aware of your spending. However, manual entry can take time, and automatic syncing is only available in the paid plan.

Cost: Free basic version, with optional paid plan for more envelopes and accounts.

Download Goodbudget on Android

SAP Concur

SAP Concur is a cloud-based platform that helps manage travel, expenses, and invoices, with its mobile app playing a big role in making these tasks easier on the go. The app lets users handle expense reports, travel plans, and invoices right from their phones, making work faster and more efficient. You can create, submit, and track expense reports easily, while snapping and uploading receipt images is quick with the app’s automatic data extraction feature, which saves time and reduces mistakes. It also tracks mileage automatically, so recording business travel is hassle-free. Managers can review and approve expenses, invoices, and travel requests right in the app, speeding up approvals and reimbursements. SAP Concur connects with many other systems like travel booking and finance software, creating a smooth workflow. Being able to access everything from anywhere boosts productivity and flexibility. This app helps save time by automating tasks, improves accuracy with automatic data checks, offers real-time spending insights, and makes expense and travel management simple. The easy-to-use design keeps employees happy and productive, making business travel and expense handling less stressful.

Cost: Business pricing plans available.

Download SAP Concur on Android

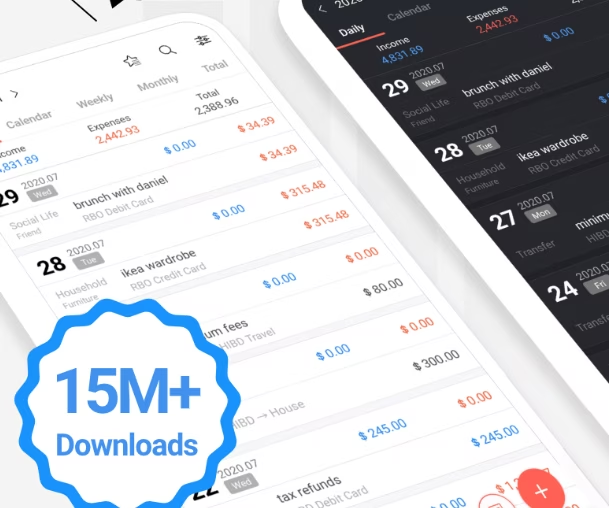

Money Manager & Expenses

Money Manager & Expenses is a handy mobile app that helps you keep track of your income and spending while managing your budget with ease. It works like a personal finance assistant, letting you record expenses, set budgets, and see clear charts and reports to understand your money habits better. You can organize your income and expenses by category and set spending limits for things like groceries or entertainment. The app tracks how well you stick to your budgets and shows your progress visually. It also helps you manage your assets, like bank accounts, all in one place. By entering your transactions manually, you get a detailed view of where your money goes. With its reports and charts, the app helps you spot areas to save and make smarter money choices. Overall, Money Manager & Expenses gives you the tools to stay on top of your finances and manage your money confidently.

Cost: Free

Download Money Manager & Expenses on Android

Download Money Manager & Expenses on iOS

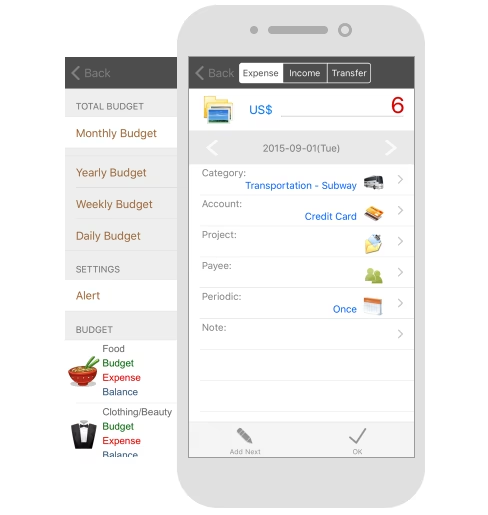

AndroMoney

AndroMoney is a personal finance app designed to help you manage your money right from your phone. It makes tracking daily expenses simple by letting you record spending, organize it into categories like groceries or bills, and add notes to each entry. You can set monthly budgets for different categories and get alerts if you go over your limits. The app supports multiple accounts, so you can keep track of checking, savings, or credit cards all in one place. AndroMoney also creates clear reports with charts to help you see where your money goes and find ways to save. Plus, it includes handy tools like a calculator, supports multiple currencies, and syncs your data across Android, iOS, and the web, so you can manage your finances anytime, anywhere.

Cost: Free, with a $3.99 premium version that removes ads.

Download AndroMoney on Android

Once you begin tracking where your money goes, you’ll get a better picture of your finances. From there, it’s easier to build a budget, save smarter, and reach your financial goals. Whether you’re managing a household, running a business, or planning travel, there’s an app here to help you stay on track.