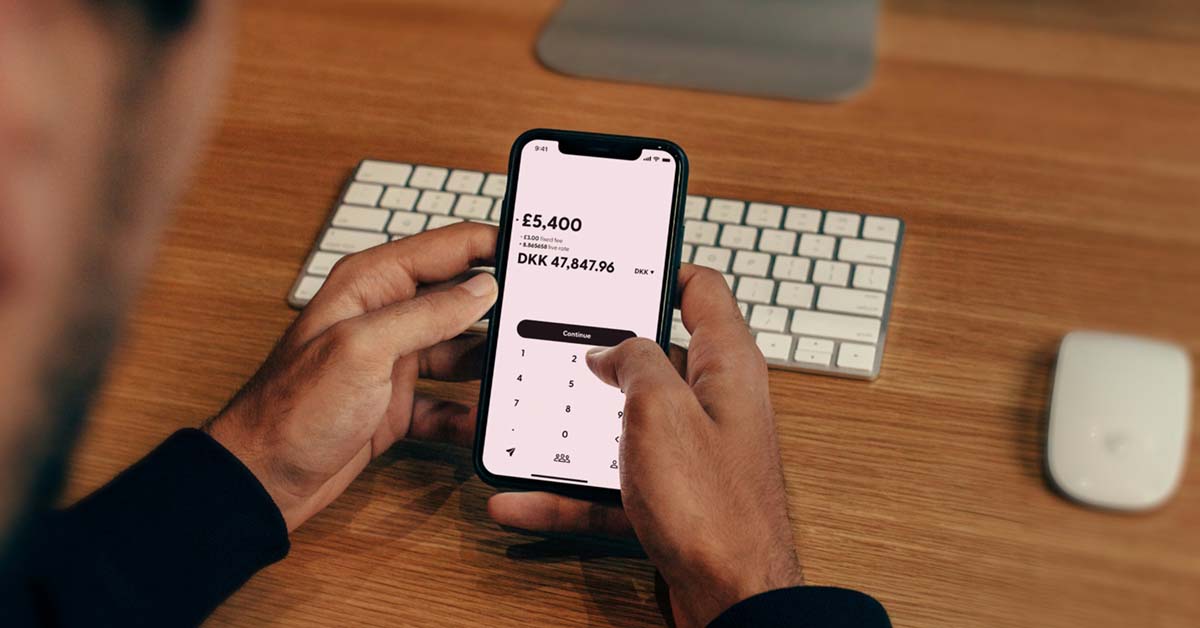

Managing your money doesn’t have to be overwhelming or time-consuming. Thanks to personal finance apps, staying on top of your budget, expenses, and savings has never been easier. Whether you’re a beginner just starting to track your spending or an expert looking to optimize investments, there’s a finance app out there for you.

In this guide, we’ll explore how personal finance apps can make your life easier, highlight some of the best options for different needs, and share tips to get the most out of these tools. Let’s dive in!

What Are Personal Finance Apps?

Personal finance apps are digital tools designed to help you manage your money. They can track your spending, create budgets, monitor bills, manage investments, and even offer financial advice. These apps are perfect for anyone looking to:

- Gain better control of their finances.

- Save money more effectively.

- Plan for financial goals like a vacation, buying a home, or retiring early.

- Monitor investments and grow wealth.

The best part? Many personal finance apps are free or low-cost and are easy to use, even for beginners.

Why Use Personal Finance Apps?

If you’ve ever struggled to stick to a budget or lost track of where your money goes, personal finance apps can be a game-changer. Here are a few reasons why they’re worth using:

- Convenience: Track your finances anytime, anywhere.

- Automation: Automate tasks like bill reminders, savings deposits, and expense tracking.

- Clarity: See a clear picture of your financial health in one place.

- Goal Setting: Set and track goals like saving for a trip or paying off debt.

- Motivation: Visual progress keeps you motivated to stick to your financial plan.

Best Personal Finance Apps for Every Need

Whether you want to create a budget, invest smarter, or split expenses with friends, there’s an app for that. Here are some top personal finance apps to consider:

1. Best for Budgeting: Mint

- Why It’s Great: Mint automatically tracks your income and expenses, categorizes them, and gives you a clear picture of your spending habits.

- Key Features: Customizable budgets, bill tracking, and free credit score monitoring.

- Ideal For: Beginners who need a simple, all-in-one tool.

2. Best for Saving: YNAB (You Need A Budget)

- Why It’s Great: YNAB helps you create a proactive budget where every dollar has a job, making it easier to save for your goals.

- Key Features: Goal tracking, financial education resources, and real-time syncing across devices.

- Ideal For: People serious about saving and paying off debt.

3. Best for Investing: Personal Capital

- Why It’s Great: Personal Capital combines budgeting with investment tracking, offering a full picture of your net worth.

- Key Features: Retirement planner, portfolio performance tracking, and fee analyzer.

- Ideal For: Intermediate to expert users looking to grow their wealth.

4. Best for Expense Splitting: Splitwise

- Why It’s Great: Easily split bills with friends, track shared expenses, and avoid awkward money conversations.

- Key Features: Group expense tracking, payment reminders, and integration with Venmo and PayPal.

- Ideal For: Roommates, couples, and group travelers.

5. Best for Debt Management: Tally

- Why It’s Great: Tally simplifies credit card management and helps you pay off debt faster by prioritizing payments.

- Key Features: Automated payments and interest rate comparison.

- Ideal For: Anyone juggling multiple credit cards.

6. Best for Freelancers: QuickBooks Self-Employed

- Why It’s Great: Track income, expenses, and mileage while preparing for tax season.

- Key Features: Invoice creation, tax estimation, and expense categorization.

- Ideal For: Freelancers and small business owners.

How to Choose the Right Personal Finance App

Not all personal finance apps are created equal. Here’s how to find the one that suits your needs:

- Define Your Goals: Are you budgeting, saving, investing, or managing debt?

- Check Compatibility: Ensure the app works on your device and syncs with your bank accounts.

- Evaluate Features: Look for features like automation, alerts, and reports.

- Consider Costs: Some apps are free, while others require a subscription. Pick one that fits your budget.

- Read Reviews: Check user reviews for insights on reliability and ease of use.

Tips for Getting the Most Out of Personal Finance Apps

- Set Clear Goals: Define what you want to achieve, like saving $500 a month or paying off a loan in two years.

- Check In Regularly: Review your app weekly to stay on track.

- Automate Where Possible: Use features like automatic savings or bill reminders.

- Categorize Expenses: Customize categories to reflect your lifestyle.

- Adjust as Needed: Update your budget or goals if your financial situation changes.

Common Challenges (And How to Solve Them)

1. Data Overload

Feeling overwhelmed by too much information? Start small by focusing on one area, like tracking expenses.

2. Inconsistent Tracking

Forgot to log expenses? Choose apps with automatic syncing to eliminate manual entry.

3. Sticking to Budgets

Struggle to follow your budget? Use apps with real-time alerts to avoid overspending.

Personal Finance Apps: FAQs

1. Are personal finance apps safe?

Yes, most apps use bank-level encryption to protect your data. Always choose reputable apps with strong security features.

2. Do I need to pay for a personal finance app?

Many apps are free, but premium versions often include advanced features like personalized advice or investment tools.

3. Can personal finance apps replace a financial advisor?

Apps are great for day-to-day management, but a financial advisor can provide tailored advice for complex situations.

Final Thoughts

Personal finance apps can transform the way you manage your money, making it easier to achieve your financial goals. Whether you’re saving for a rainy day, investing for the future, or just trying to get a handle on your budget, there’s an app that can help.

Start small by downloading one app and exploring its features. Over time, you’ll gain the confidence and skills to take full control of your finances. Remember: every small step you take today brings you closer to financial freedom.

So, what are you waiting for? Download a personal finance app today and start your journey to a brighter financial future!